The impact of no safety net among underrepresented tech founders

November 27, 2021

It’s difficult for anyone to be a tech startup founder. Unless you can do your own coding, the tech development costs can be prohibitively expensive. Over the years, I’ve met many startup founders of all backgrounds. They have great ideas, big dreams, and their passion in common. The difference I’ve seen is how long someone has to work on their startup before they have to give up and get a regular job or for their start-up to take flight. Many underrepresented founders I know give up after a year of tapping into their savings because they can’t get the funding they need. They are willing to tap into their savings and use their credit cards, but they just don’t have as much savings or as high of credit limits. They just don’t have the safety net or the connections to people with money.

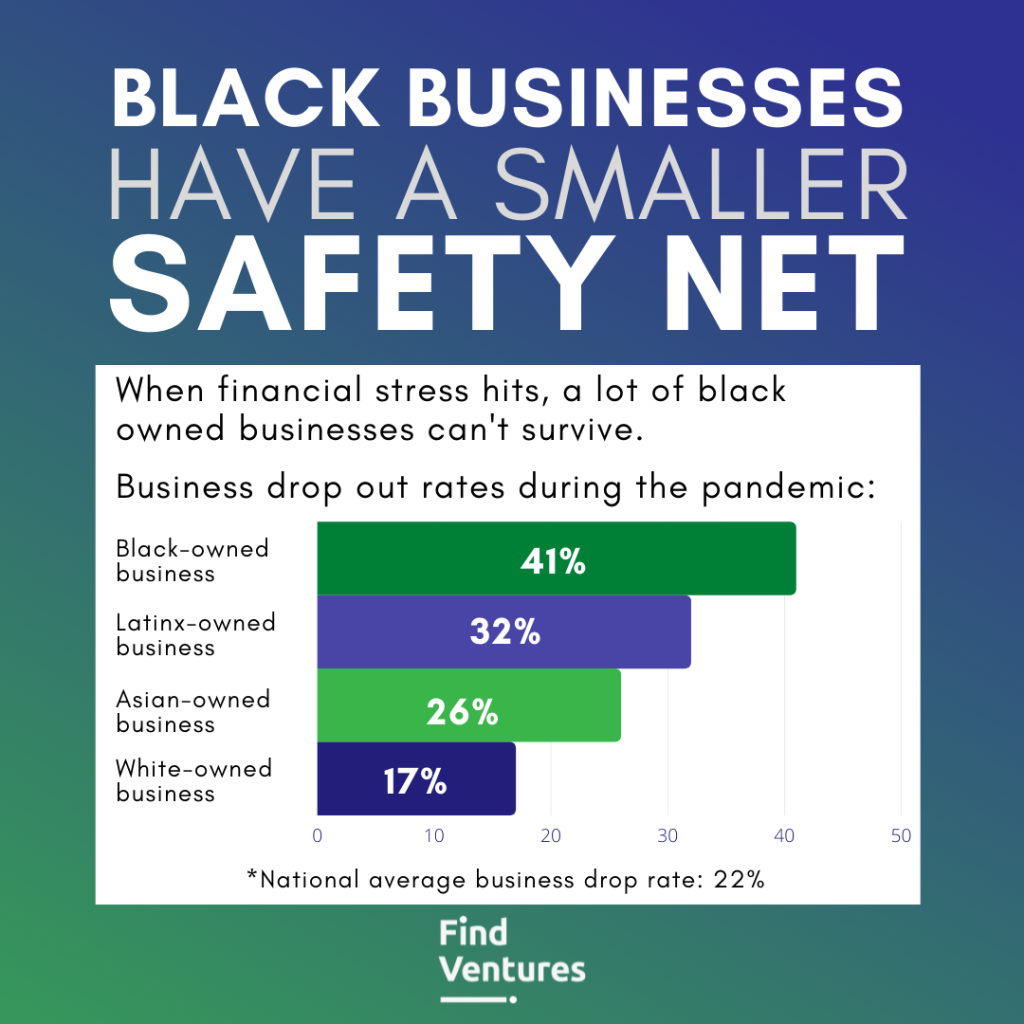

Of funded tech founders, nearly 95% are made up of white and Asian people, which means the remaining 5% is made up of all the other racial groups. You can see this difference in founders’ safety net by analyzing the racial makeup of businesses that failed during the pandemic.

The national average dropout rate was 22%. Asian business owners dropped out at 26%, Latinx business owners at 32%, and black business owners at 41%. White business owners averaged a 17% dropout rate. The lack of a safety net and savings can partially explain the high dropout rate.

When you compare new black-owned businesses with new white-owned businesses, the latter has almost 3 times more in terms of overall capital. Profitability is impacted by the lack of access to startup capital. We analyzed 17 different funders who give grants to serve underrepresented founders. The average grant size is under $20,000. This doesn’t even come close to helping underrepresented founders reach parity with white founders.

Aside from owner’s equity, even black-owned businesses have a much weaker relationship with banks, making it more difficult to borrow money. One third of healthy black businesses get funding from banks compared to their white counterparts. A lot of this is reflective of the impact of generational wealth creation. Families that have money continue to grow their wealth and families that don’t have wealth to begin with find it very difficult to grow wealth later on.

There’ve been many studies on the black-white income gap. The average wealth of white families is 20 times more than average wealth of black families. The average white business is valued at 12 times more than the average black business. With such disparities to start with, you can understand why it is so difficult to level the playing field.

And yet investing in entrepreneurship can allow people to accumulate generational wealth. The median net worth for Black business owners was 12 times higher than for Black non-business owners1.

While the above-mentioned statistics are on racially underrepresented founders, women are also underrepresented among funded tech founders. Only 9% of all funds for tech startups go to founding teams that have at least one woman. This is despite the fact that research shows women who received less than funding still generate more revenue than their male counterparts. They are able to do more with less. So imagine what would happen if we gave them more.

Get Involved with Find Ventures or make a donation to the Founders Fund here.

Written by Dr. Julie Pham, Find Venture’s Curiosity Director, Founder and Author of the 7 Forms of Respect™, and CEO of CuriosityBased.

1A Congressional Black Caucus Foundation (CBCF) study https://www.cbcfinc.org/wp-content/uploads/2019/05/CPAR-Report-Black-Entrepreneurship-in-America.pdf (article: https://www.forbes.com/sites/brianthompson1/2021/06/17/the-key-to-closing-the-racial-wealth-gap-black-entrepreneurship/?sh=3c1313ad5bec) “The Key To Closing The Racial Wealth Gap: Black Entrepreneurship” Brian Thompson